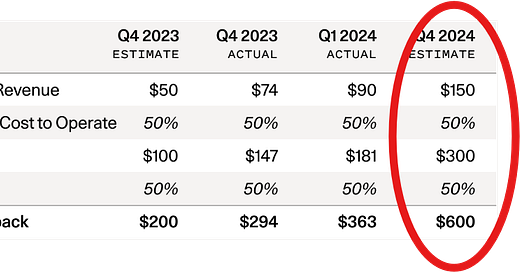

David Cahn from Sequoia did some basic math on Nvidia’s data center revenue. Here’s the breakdown

Nvidia made: $150B (from datacenters alone!)

It costs Nvidia’s customers (Goog, Meta, Amzn, MSFT) ‘2X the chip cost’ to run the datacenter

So their total expenses: $300B

Amzn/Goog/Meta/Msft need to make profits. Assume 50% gross margin. So 2Xing this again.

Total needed to recoup: $600B

Big question - Who’s making all this money in Gen AI?

He does some generous math and still can’t fill this $600B hole.

His conclusions therefore

there is a massive amount of over-capacity build-up in infra.

There doesn’t seem to be enough killer apps that can make up the $600B.

Ergo, a lot of stock valuations are going to take a hit.

An easy argument to make against him would be

The 2000s saw the same overcapacity in fiber-optic cables

1850s saw the same overcapacity in train tracks

GPU overcapacity is similar. It will be monetized eventually

And herein his counter-point

Datacenters are very different from Railway tracks.

Why?

Physical infra like a railway track from NYC to SF has intrinsic value. As you can’t just lay new tracks between 2 cities that easily.

Nvidia’s B100 will have 2.5X better performance over the H100. Hence older datacenters will depreciate faster

While he believes strongly that AI will be a huge disruption, “Capital Incineration” is a way of life during ‘speculative investment frenzies.

Meanwhile, a top Goldman Sach’s economist has a similar analysis. His numbers are even more startling - $1 Trillion of capital investment needs to recouped.

Great reads

Goldman’s Top Stock Analyst Is Waiting for AI Bubble to Burst

AI’s $600B Question (David Cahn’s latest analysis)

AI’s $200B Question (David Cahn’s older analysis from last year)